Introduction

Your credit score plays a crucial role in your financial life. It’s a number that lenders, landlords, and even some employers look at when evaluating your financial reliability. A good credit score can help you secure loans with favorable interest rates, qualify for a credit card with benefits, and even get better insurance rates. On the other hand, a poor credit score can make it difficult to get approved for loans or lead to higher costs for borrowing.

Understanding how credit scores work and what factors influence them is essential for managing your finances. This article will explain what credit scores are, how they’re calculated, and provide actionable tips on how to improve your score.

What is a Credit Score?

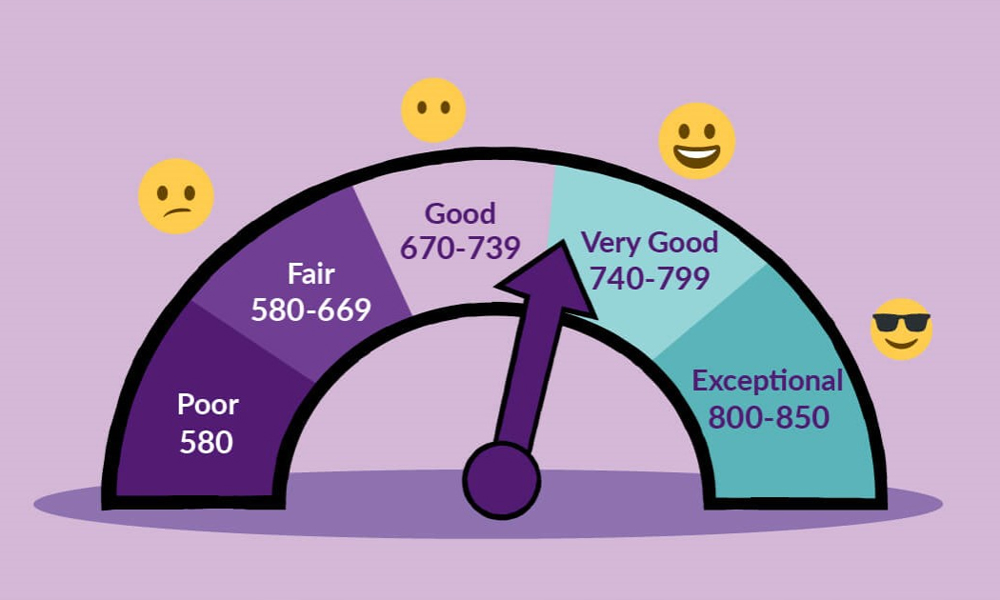

A credit score is a numerical representation of your creditworthiness, which is based on your credit history. The score helps lenders assess the risk of lending money to you. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

The most commonly used credit score model is the FICO score, but other models like VantageScore are also widely used. While different scoring models may vary slightly, the range remains the same.

Credit Score Ranges:

- Excellent (750 – 850): You’re likely to qualify for the best interest rates and credit terms.

- Good (700 – 749): You’re in a solid position for most loans and credit cards.

- Fair (650 – 699): You may face higher interest rates or more stringent approval criteria.

- Poor (550 – 649): You may struggle to get approved for credit, and if you are approved, interest rates will likely be high.

- Very Poor (300 – 549): It may be very difficult to get approved for loans or credit cards with this score.

Factors That Affect Your Credit Score

Your credit score is calculated based on several factors, each contributing to the total score. Understanding these factors can help you take steps to improve your score.

- Payment History (35%): Your payment history is the most important factor in determining your credit score. It shows whether you pay your bills on time, including credit cards, mortgages, car loans, and other debts. Late payments, defaults, or bankruptcies can significantly lower your score.

- Credit Utilization (30%): Credit utilization refers to the amount of credit you’re using relative to your total available credit. For example, if you have a $10,000 credit limit and you’ve used $5,000, your credit utilization rate is 50%. Generally, it’s recommended to keep your credit utilization rate below 30% to maintain a healthy score.

- Length of Credit History (15%): The longer you’ve had credit, the more favorable it is to your score. Lenders like to see that you have experience managing credit over time. If you have newer credit accounts, this might slightly lower your score, but it will improve with time.

- Credit Mix (10%): Having a diverse mix of credit accounts—such as credit cards, auto loans, student loans, or mortgages—can positively impact your score. It shows lenders that you can manage various types of credit responsibly.

- New Credit Inquiries (10%): Each time you apply for credit, a hard inquiry is made on your credit report, which can cause a small, temporary dip in your credit score. Multiple credit inquiries in a short period may indicate riskier behavior and can negatively impact your score.

How to Improve Your Credit Score

Improving your credit score takes time and discipline, but it’s absolutely possible. Here are some actionable steps you can take to boost your score.

1. Pay Your Bills on Time

One of the most effective ways to improve your credit score is to consistently pay your bills on time. Payment history makes up 35% of your credit score, so late or missed payments can severely damage your score. Set up reminders or automate payments to avoid late fees and negative marks on your credit report.

2. Reduce Your Credit Card Balances

Credit utilization plays a significant role in your credit score. Try to keep your credit card balances below 30% of your credit limit. If possible, pay off your balances in full each month. Lowering your credit utilization rate not only helps your score but also saves you money in interest payments.

3. Avoid Opening Too Many New Credit Accounts

While it can be tempting to open new credit accounts to increase your available credit or take advantage of rewards, doing so can negatively impact your score. Each time you apply for credit, it can result in a hard inquiry, which can lower your score temporarily. Opening multiple new accounts in a short period can also signal to lenders that you may be financially unstable.

4. Keep Old Accounts Open

The length of your credit history is an important factor in your credit score. Even if you’re not using an old credit card, keep it open to boost the average age of your accounts. Closing old accounts can reduce your credit score by shortening your credit history and increasing your credit utilization rate.

5. Diversify Your Credit Mix

Lenders like to see that you can manage a variety of credit accounts. If your credit history is primarily limited to one type of account (e.g., credit cards), consider diversifying by adding other types of credit, such as a car loan or a personal loan. However, only open new accounts if necessary, as it may take time to build a positive history with each.

6. Regularly Check Your Credit Report

Mistakes or fraud on your credit report can drag down your score. Check your credit report regularly to ensure all information is accurate. You are entitled to a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once a year. Dispute any errors you find to keep your credit report accurate.

7. Settle Outstanding Debts or Collections Accounts

If you have accounts in collections, it can significantly hurt your credit score. Work with your creditors to settle or pay off these accounts. After settling, the negative mark will remain on your credit report for some time, but your score can begin to recover once the debt is resolved.

Common Myths About Credit Scores

- Closing Credit Cards Improves Your Score: Closing credit cards can actually hurt your credit score by reducing your available credit and shortening your credit history. It’s generally better to keep old accounts open, especially if they don’t have an annual fee.

- Checking Your Own Credit Hurts Your Score: Checking your own credit report is considered a soft inquiry, which does not impact your credit score. Monitoring your credit is a smart way to stay informed about your financial health.

- Income Affects Your Credit Score: Your income does not directly affect your credit score. However, your income can affect your ability to make timely payments, so managing your debt relative to your income is crucial.

Conclusion

Understanding your credit score and how it’s calculated is essential for managing your financial health. A good credit score opens doors to better financial opportunities, while a poor credit score can limit your options and cost you more money. By paying your bills on time, reducing your credit card balances, and being mindful of your credit activity, you can improve your score over time.

Improving your credit score requires patience and discipline, but the effort is well worth it. Start by taking small steps, and over time, you’ll see positive changes in your credit report. By consistently managing your credit, you can achieve a better score and, ultimately, a stronger financial future.